Open Banking in Australia: Hesitation Equals Failure

Australian Banks Should Build (APIs) Rather Than Baulk (At Open Banking).

The open banking revolution seems to be gaining traction in Australia. Treasurer, Scott Morrison, announced on July 20th that Australia’s banking sector will come under review in a bid to figure out how the open banking regime should work in practice by the end of this year.

It remains to be seen whether the financial services sector will meaningfully get on board with “open banking” and how fast they’ll implement the necessary technology infrastructure. For centuries, big banks have enjoyed an undisturbed status, backed by government, high barriers to entry and consumer inertia. Many banking products and services are still poor, dated and expensive.

Until recently, Australia’s big banks have resisted the open banking push, citing security and privacy concerns, and called for the government to leave it to market forces to improve competition. Meanwhile, the open banking regime is gathering pace in the UK and Europe with the European Union’s second payment services directive (PSD2) coming into force in January 2018.

Fintechs, both globally and in Australia, are launching innovative products and services set to lure consumers away from the banks through integrating financial, commercial and social into slick apps. Silicon Valley’s tech giants, notably Google, Facebook and Apple, are also entering the fray.

In the UK and Europe, the mood is certainly shifting from existential fear of disintermediation to enthusiasm for the opportunities ahead and banks now universally see open banking as a strategic opportunity, embracing it proactively and ambitiously. One thing’s certain - taking a sluggish, half hearted approach to open banking will only leave Australian banks exposed to globalised fintech innovation in the foreseeable future.

Open Banking Defined

Open banking means that banks will have to shift from being one-stop-shops for financial services to open platforms, where consumers can embrace a more modular approach to banking as it becomes easier to compare banks and their products.

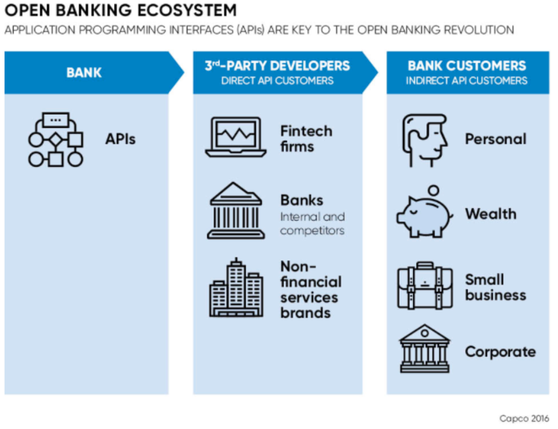

This is not just driven by market forces and technology but through legislation. In the EU, UK and now Australia, regulators are pushing the open banking regime which will force banks to share otherwise hidden data (if the consumer consents) and build APIs.

Those APIs will allow third parties to plug into the bank’s underlying services and build products on top of the bank’s infrastructure. APIs are the vital glue that will enable seamless interaction between the banks and new players and facilitate more suitable and efficient products and services. Open banking will therefore force the ‘Big 4’ to rethink their customer engagement models and leverage APIs more effectively to serve increasingly mobile, tech-savvy customers.

Tom Blomfield, CEO of UK challenger bank, Monzo, predicts that “the bank of the future will be a marketplace”. He rightly notes that open banking requires a huge shift in mindset and, much like the music industry’s tight control pre-iTunes, open banking pushes banks to become platform businesses.

Source: https://www.raconteur.net/finance/upcoming-eu-directive-to-open-up-banking April 23, 2017

Australia’s shifting landscape

Australian banks have, until recently, opposed the push for an open data regime.

As part of the Productivity Commission’s review of whether Australia should adopt a compulsory open banking policy, held in 2016, the Big 4 argued that open banking implementation would be costly and raise security concerns. The Australian Bankers' Association (ABA) said open banking should be allowed to “occur organically”.

But fintechs and venture capital investors have long argued that open banking would increase productivity, reduce costs, time and effort required to switch banks, and empower consumers to use their data to be able to make better financial decisions. It is not hard to see why big banks have pushed back.

In what seems to be a dramatic change of tune from its comments only a year ago, the ABA’s Chief Executive, Anna Bligh, said recently that an open data regime is “just the beginning” of the wave of disruption set to hit Australian banks and open up opportunities for smaller fintech players. Ms Bligh also conceded that “in just a few years banking could look very different than it does today”.

Tech giants’ foray into banking has been the subject of much speculation over the past few years. An Accenture report from January 2017 found that approximately 30% of global respondents would switch to Google, Amazon or Facebook for banking. While Silicon Valley firms may not want to become banks in their own right, they certainly have the advantage of having grown up in the digital age and are well positioned to win over banking customers with cutting edge websites and superior apps.

Facebook was recently reported to have won an Australian patent for technology that would allow peer to peer payments via its messenger service, much to the dismay of local banks who have reportedly spent over $1 billion on their own P2P payment network.

There is no doubt that financial industry incumbents will have their work cut out.

Fintechs on the rise

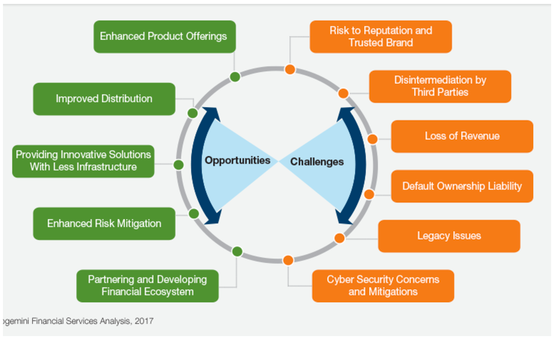

The World Retail Banking Report 2017 (recently published by Capgemini and Efma) (WRBR) explored how banking is evolving into an open-source model and urged banks to embrace and lead this evolution to maintain and build customer relationships and avoid disintermediation. The Report notes that banks collaboration with fintechs is key in order to offer more innovative and personalised services. While banks have traditionally reacted to fintech with a mix of denial and suspicion, it seems that global attitudes are changing, with over 90% of global banks and over 75% of fintechs surveyed in the WRBR saying they expect to collaborate in the future.

The report also highlights that fintechs earn high marks when it comes to customer experience and that global trends show that young, tech savvy customers are likely to turn to fintechs for financial services. This is hardly surprising, with the vast majority of millennials already banking on their mobile and laptops, using digital wallets and peer-to-peer payment apps. Banks are clearly coming to terms with the new reality in which their traditional, complacent customer base, scale and trusted brands won’t necessarily guarantee their future survival.

Source: Capgemini & Efma World Retail Banking Report 2017: https://www.worldretailbanking...

The mistake the telcos made was to not move forward in a legacy area; to not create the synergies that are possible when everyone has the same kind of platform or solution

Pietro Sella

CEO of Banca Sella

As Pietro Sella, CEO of Banca Sella and longtime open banking advocate, rightly says banking is at a similar inflection point to that of the telecoms sector a few years ago: “Think about WhatsApp and similar services. When they took control of the contact list on smartphones, they took the entire SMS market from the telcos. The mistake the telcos made was to not move forward in a legacy area; to not create the synergies that are possible when everyone has the same kind of platform or solution. Banks could cooperate in order to save costs in areas where there is no longer competitive advantage and to create platforms that let them compete in new areas and capture new customers.”

While Australian consumer demand for and openness to using fintech offerings is currently relatively low compared to the US, UK, HK and Singapore, there is no doubt that Australians’ receptiveness to digital banking solutions is growing and will be underpinned by millennials’ appetite for simple, high-convenience banking.

The Australian FS sector as a whole should and will be able to compete globally in the future. Australia has fantastic fintechs and the sector is largely optimistic about the future. It remains to be seen how remaining challenges around talent, capital, regulation and government policy will unfold and if Australia will rise to the challenge and make the most of its competitive advantages to become a true global fintech leader.

Fintechs are unquestionably changing the landscape and Australia’s fintech ecosystem is growing rapidly, with over 350 companies dominating the space. Startups like Spaceship, Tyro, Finch, CoinJar and ANX International (an Australian startup based in HK) are set to challenge Australia’s banking, capital markets and superannuation industries.

Partnerships such as the one recently signed between the CBA and Austrade to support the flow of fintech innovation between Australia and the UK, the Comm Bank’s Innovation Lab and NAB Lab’s incubator are all positive signs and should be encouraged.

However, bank engagement still remains a challenge for startups. Toby Gardner, Co-Founder of Finch, an Australian fintech reimagining the consumer finance experience through a financial app for your social life, thinks that “the number one challenge to collaboration is the same: organisational structure, culture, and process. The banks’ existing structures are not designed to be efficient or effective in allocating resources towards startup collaboration, their culture still reveals a “we can do this better ourselves” attitude, and their partnership process is built for existing companies – who have the resources and time to wait 6-12 months before anything meaningful happens (or in most cases, not at all).”

Asher Tan, CEO of CoinJar, points out that ”while Australian banks continue to struggle collaborating even with household names like Apple, there is evidence that some banks have worked with startups to drive internal efficiencies. Startups solving pain points like creating cost savings in back-office functions are most likely to succeed when working with the Big 4.

Engagement can also happen through other avenues such as bank sponsored venture capital funds. However, startups who aim to bring objectively better benefits directly to consumers will likely struggle as their products will often come in direct competition with bank offerings.”

Incumbents are generally moving from the FOMO stage to an acceptance stage. Instead of innovating out of a pure fear of missing out, they are now appreciating that FinTech is going to radically change the way they operate.

Dave Chapman

MD @ Octagon Strategy & COO @ ANX International

From FOMO to Acceptance

This begs the question of whether banks can indeed drive innovation and proactively self-disrupt.

Dave Chapman, Co-Founder and COO of ANX International and MD of Octagon Strategy, two fintechs that operate in the blockchain technology space, thinks that “incumbents are generally moving from the FOMO stage to an acceptance stage. Instead of innovating out of a pure fear of missing out, they are now appreciating that FinTech is going to radically change the way they operate. This is proven by the increasing investment from the traditional players in the financial services field.” However, he stresses that greater regulatory certainty would assist: “Governments and regulators are already opening up the doors; the FinTech industry is now more connected with the regulators than it has been than ever before. It's mutually beneficial for both FinTech and regulators to collaborate and this is the first step to better understanding the needs and thus dedicating the appropriate resources.”

According to Toby Gardner, “banks are genuinely interested in innovation but they lack the talent, process, and culture to be successful and no one wants to admit it. Innovation is chaotic, messy and uncertain. It needs radically different tools for management, measurement and control as well as team dynamics and skill set. Banks are still convinced they can fit a round peg in a square hole. So did Kodak.”

Asher Tan of CoinJar believes that “cultural elements in incumbents mean even though firms are genuinely interested in innovation, there is a lack of decision makers willing to commit time, energy, and their careers to make change happen. True innovation necessitates champions, be it individuals or companies, willing to take risks and have skin in the game. CoinJar is a great example of a company willing to explore a totally new field of finance, digital currency, in spite of intrinsic industry risk. We’ve managed to build numerous products and cater to loyal customers over the last four years while incumbents worry about the reputational risk of being associated with Bitcoin.”

Open banking: Threat or Catalyst?

According to the WRBR, “with APIs acting as a bridge between systems, banks can gain much more value by viewing them in the big picture. While the customer data they own will enable banks to claim a central role in the evolving digitally connected ecosystem, how large a role they occupy will be up to them. As the new banking models play out, banks will have to make strategic choices about the specific roles they would like to take on in the future, and will need to frame their strategy accordingly.”

If banks decide to do nothing (or very little) with open banking, they risk becoming obsolete brands and transforming into mere utilities or ‘dumb pipes’. In addition to siloed cultures and lack of technology leadership on boards, one of the biggest issues for European banks has been building appropriate enterprise data architecture. Without the latter, banks will not be able to leverage consumer analytics, AI or other cutting edge technologies.

Open banking invariably means embracing cloud-native design principles, DevOps ways of working, automated security and next generation surveillance technologies while also integrating these modern elements with older legacy banking platforms on the backend. Banks need to accept that decentralising their own product building efforts is a must in order to achieve an innovative application ecosystem.

The advent of privacy and security legislation (such as the EU’s General Data Protection Regulation (GDPR) in May 2018 and Australia’s new mandatory data breach notification laws) will also help nudge banks in the right direction.

References

1- https://www.raconteur.net/finance/upcoming-eu-directive-to-open-up-banking

2- http://thefinanser.com/2015/04/why-fintech-banks-will-rule-the-world.html/

3- http://www.afr.com/technology/banks-resist-fintech-push-for-open-data-regime-20160816-gqthn0/

4- http://www.innovationaus.com/2017/07/Anna-Bligh-on-open-bank-data/

5- http://fortune.com/2017/01/11/google-facebook-amazon-banking/

6- http://www.afr.com/business/media-and-marketing/facebook-wins-australian-patent-for-messenger-payments-20170629-gx1qgk

7- https://www.worldretailbankingreport.com/

8- https://thefinancialbrand.com/62278/banking-millennial-digital-mobile-marketing/

9- EY Fintech Australia Census 2016.

10- https://www.worldretailbankingreport.com/rise-of-open-banking